In a landmark vote that has ignited fierce debate on both sides of the aisle, Congress has passed the “Big Beautiful Bill” — a sweeping package of healthcare and tax reforms that could reshape the nation’s economy and safety net for years to come.

The bill, praised by its authors as a long-overdue modernization of federal programs, passed narrowly along party lines, with just enough moderate support to push it through. But critics warn the legislation could lead to millions losing insurance and deepen inequality.

What’s in the Bill?

The Big Beautiful Bill includes major changes across three key areas:

Healthcare Reforms

- Medicare eligibility will rise from 65 to 67 over the next five years.

- Medicaid will shift to a block grant model, giving states more flexibility — but less guaranteed federal funding.

- Affordable Care Act (ACA) subsidies will be reduced and restructured, potentially increasing out-of-pocket costs for middle-income families.

According to the Congressional Budget Office, these changes could result in 7 million Americans losing health coverage by 2035.

Left vs. Right: The Talking Points

The reaction from lawmakers and advocacy groups has been swift — and deeply polarized.

“This is a betrayal of working Americans and seniors,” said Rep. Aisha Nunez (D-NY). “You can’t gut healthcare access just to hand out more tax breaks to corporations.”

“This bill restores fiscal sanity and puts control back in the hands of the states,” countered Sen. Jack Rutledge (R-TX). “It ends federal overreach and gives Americans more freedom to choose.”

Tax Cuts: Relief or Risk?

One of the most controversial elements of the bill is its aggressive tax overhaul:

- Corporate tax rate lowered from 21% to 18%

- Top individual tax rate cut from 37% to 35%

- A temporary child tax credit expansion, set to expire in 2027

Supporters argue that the cuts will boost investment, spur job creation, and stimulate economic growth. However, critics warn the cuts are skewed toward the wealthy and could increase the federal deficit by more than $1.3 trillionover the next decade.

“Trickle-down economics didn’t work in the 80s, and it won’t work now,” said progressive economist Lena Tsai. “The middle class is being squeezed to fund yachts.”

👥 Who’s Most Affected?

| Group | Potential Impact |

|---|---|

| Seniors aged 65–66 | May need private insurance or delay retirement |

| Low-income families | Medicaid coverage depends on state decisions |

| Parents | Temporary tax relief, but no long-term guarantees |

| Small businesses | Lower tax rates and new write-offs |

| High earners | Receive the largest tax breaks under the bill |

The Fallout: What Happens Next?

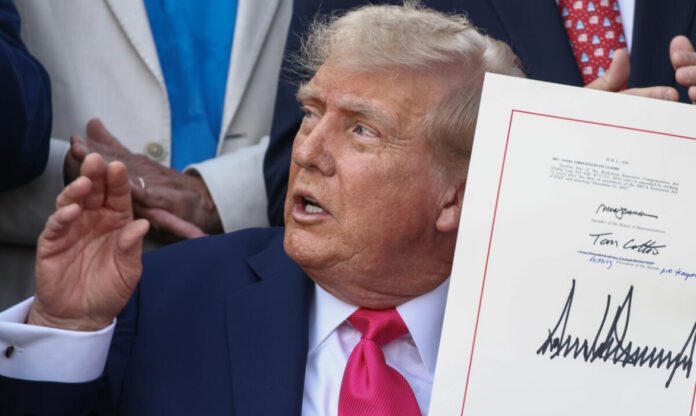

With the President expected to sign the bill into law within the week, all eyes now turn to the states, where governors and Medicaid directors must decide how to implement the new funding model.

Healthcare advocacy groups are already preparing legal challenges, and several Democratic-led states have promised to maintain current coverage levels regardless of federal cuts — but how long that will last remains unclear.

The Bottom Line

The Big Beautiful Bill is big, bold, and — depending on who you ask — either a fiscal breakthrough or a social disaster.

Whether it fulfills its promise to revitalize the economy and modernize healthcare, or leaves millions behind in the process, will depend on how it’s rolled out — and how the public reacts.

Stay with BuzzandBeats for full coverage, interviews, and analysis of this historic legislation.