Introduction: How Much Should You Save for Retirement?

One of the most common questions people ask when thinking about their financial future is: how much should you save for retirement? It’s a critical question, and one that doesn’t have a single, universal answer. The right amount depends on your age, lifestyle, income, goals, and how long you expect to live in retirement. Despite these variables, there are smart benchmarks and strategies that can help guide you toward the right savings milestones.

Most experts agree that saving early and consistently is the key to long-term success. The earlier you start, the more time your money has to grow through compound interest. Still, many people find themselves unsure if they’re on track or saving enough for their age. That’s why understanding how much you should save for retirement at each stage of life 30s, 40s, 50s, and 60s, can help eliminate the guesswork and provide a clear path to financial security.

Whether you’re just starting your career or approaching retirement, the idea of building a retirement fund can feel overwhelming. You may be juggling student loans, a mortgage, kids’ expenses, or business investments, but retirement savings don’t have to come at the cost of your current life. Small, steady contributions over time can add up to significant results.

This guide breaks down how much you should save for retirement by each decade of your working life. It gives you benchmarks based on income multiples and real-world strategies to help you stay on track, or catch up if you’ve fallen behind. It’s not about perfection; it’s about progress. Even if you can’t meet every benchmark exactly, just understanding where you stand and what to aim for can make all the difference.

And remember, retirement isn’t just about numbers. It’s about creating a future where you’re free to do what you love. Whether that’s traveling, spending time with family, starting a new venture, or simply enjoying peace of mind, the sooner you start planning and saving, the more flexibility and freedom you’ll have to make your dream retirement a reality.

In the sections that follow, we’ll explore retirement savings benchmarks by age and offer tips to boost your savings at any stage. So if you’ve ever wondered how much should you save for retirement, you’re in the right place. Let’s break it down and help you build a secure and confident financial future.

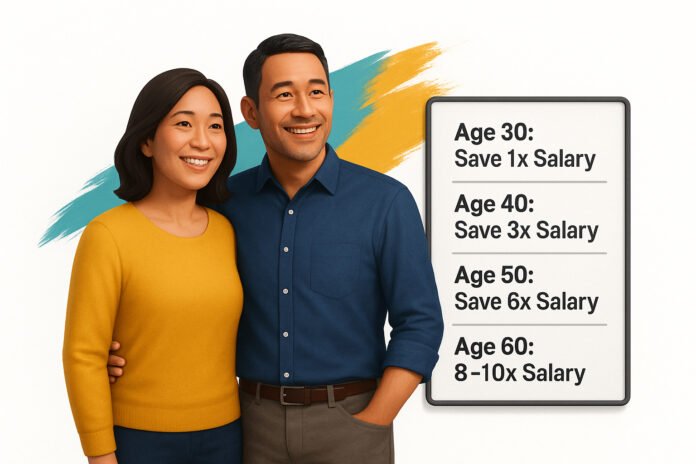

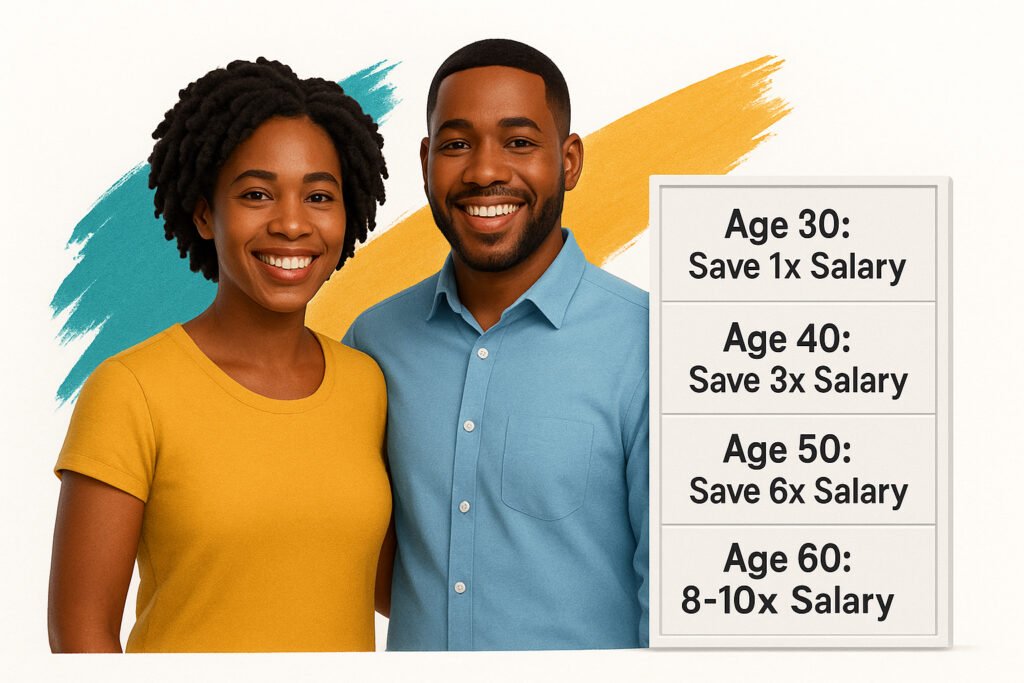

How Much Should You Save for Retirement by Age 30

By age 30, financial experts recommend having saved at least one year’s salary for retirement. For example, if you earn $50,000 annually, aim to have $50,000 saved in your retirement accounts.

Tips for 20s and 30s:

If you’re wondering how much you should save for retirement but haven’t started yet, now is the time to begin, even small amounts add up over time.

How Much Should You Save for Retirement by Age 40

At age 40, a good rule of thumb is to have saved about three times your annual salary. If you make $80,000 a year, your target savings should be around $240,000.

How to catch up if behind:

Knowing how much you should save for retirement at this stage lets you course-correct before the final push.

How Much Should You Save for Retirement by Age 50

By 50, you should aim to have saved about six times your salary. If you earn $100,000, that means $600,000 in savings.

Strategies to maximize savings:

Understanding how much you should save for retirement at 50 helps you prepare for the home stretch.

How Much Should You Save for Retirement by Age 60

By the time you reach 60, your goal should be to have saved eight to ten times your salary. For a $120,000 salary, that’s $960,000 to $1.2 million.

Final tips:

Knowing how much you should save for retirement by 60 lets you plan a comfortable retirement lifestyle.

What to Do If You’re Behind on Retirement Savings

If you’re unsure how much you should save for retirement or feel behind on your goals, don’t panic. You can still catch up by:

The key is to take consistent action starting now.

Final Thoughts

Understanding how much should you save for retirement isn’t just about hitting a specific number, it’s about building a flexible financial plan that supports your unique goals and lifestyle. Everyone’s path to retirement is different, but the benchmarks by age 30, 40, 50, and 60 offer helpful guidance to stay on track.

The earlier you begin saving, the more time compound interest has to work in your favor. Even if you’re behind, don’t panic. What matters most is that you start now and stay consistent. Automate your contributions, increase your savings rate when possible, and revisit your plan each year to ensure it reflects any changes in your income or retirement goals..

Remember, retirement planning isn’t a one-size-fits-all strategy. Talk with a financial advisor to tailor your retirement plan to your needs and maximize your savings. The more informed you are, the more confident you’ll feel about your future.

For additional retirement planning resources and personalized tools, check out Investopedia’s Retirement Guide to deepen your understanding and make smarter financial decisions.

In the end, asking yourself how much should you save for retirement is the first step toward a financially secure future; and by taking action today, you’re already ahead of the game.

Figuring out how much you should save for retirement isn’t always easy, but using age-based benchmarks helps create a clear roadmap. Whether you’re just starting or need to catch up, having specific goals by age can motivate and guide your savings efforts.

Remember, every dollar you save today can grow into a larger nest egg tomorrow. Stay consistent, plan wisely, and you’ll be well on your way to a secure, comfortable retirement.

For more detailed guidance, visit Fidelity’s Retirement Savings Guide.