Introduction to Minimize Your Tax Liability

One of the smartest financial decisions you can make in 2025 is to minimize your tax liability. While paying taxes is mandatory, overpaying is completely avoidable. With proper planning, smart strategies, and a proactive mindset, you can significantly minimize your tax liability and keep more of your hard-earned income.

When most people think about taxes, they assume the amount they owe is fixed. But in reality, there are dozens of legal ways to minimize your tax liability. Whether you’re an yesemployee, a freelancer, or a small business owner, you have options to reduce how much you owe the IRS. The key is knowing the right steps and applying them consistently.

To minimize your tax liability, you need to think beyond just filing your taxes every April. Real savings come from strategic year-round planning. Deductions, credits, and account contributions can all be used to legally lower your tax burden, if you act early. These tactics aren’t just for the wealthy. Anyone can take steps to minimize your tax liability, regardless of income.

In 2025, the IRS has updated several thresholds and expanded certain benefits. This makes it an ideal time to revisit your financial habits and apply proven strategies to minimize your tax liability. From contributing to tax-advantaged accounts like 401(k)s and HSAs to adjusting your withholding or claiming education credits, you have more control than you think.

What many don’t realize is that most people leave money on the table every year simply because they didn’t take action early enough. If your goal is to save money, protect your income, and plan ahead, your first priority should be to minimize your tax liability through smart decisions now, not later.

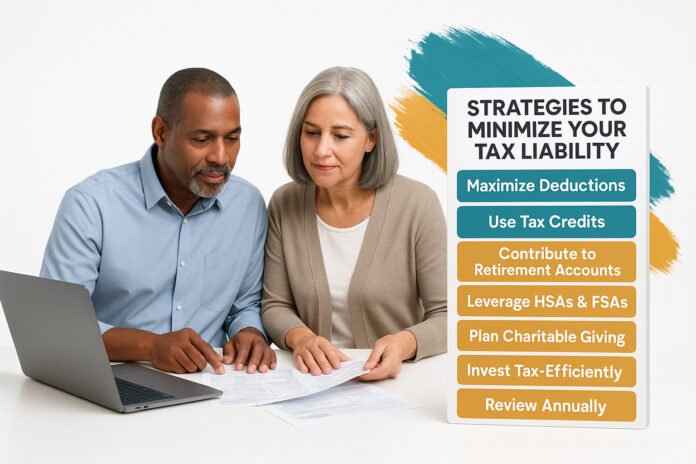

This guide covers seven smart, IRS-compliant strategies you can use this year to legally minimize your tax liability. These are not gimmicks or shortcuts; they are reliable, proven techniques that millions of Americans already use to save thousands annually.

Whether your goal is to grow your retirement fund, save for a home, or build generational wealth, it all starts with making smarter decisions about taxes. Learning how to minimize your tax liability puts more money back in your hands and gives you the flexibility to make better financial choices going forward.

So if you’re tired of giving the government more than necessary, or you want to finally take control of your financial future, you’re in the right place. The strategies in this article will show you exactly how to minimize your tax liability and take back control of your income, legally and confidently.

Let’s explore the seven most powerful ways to minimize your tax liability in 2025.

1. Maximize Retirement Contributions

One of the most effective and legal ways to minimize your tax liability is to contribute to retirement accounts. Contributions to traditional IRAs, 401(k)s, and SEP-IRAs (for self-employed individuals) reduce your taxable income for the year.

In 2025, the IRS allows contributions of up to:

These contributions grow tax-deferred, meaning you don’t pay taxes on the investment earnings until you withdraw them during retirement, when your income (and tax bracket) may be lower.

Additionally, self-employed individuals can benefit from SEP IRAs or Solo 401(k)s, which allow even higher contribution limits. If you’re a small business owner or freelancer, leveraging these retirement vehicles can offer substantial tax savings.

By prioritizing retirement savings, you’re not just planning for your future, you’re also actively reducing your tax bill in the present.

2. Take Advantage of Tax Credits

Tax credits directly reduce the amount of tax you owe, dollar for dollar. Unlike deductions that reduce your taxable income, credits are a more powerful tool to minimize your tax liability.

Here are some of the most impactful tax credits for 2025:

Even partial eligibility can result in hundreds or thousands of dollars in savings. Some credits, like the EITC, are even refundable, meaning you can receive a refund even if you owe no tax.

Before filing, review IRS Form 8863 and the qualifications for each credit to ensure you’re not leaving money on the table. Each credit you qualify for can significantly minimize your tax liability without needing to alter your income or lifestyle.

3. Claim All Eligible Deductions

Tax deductions reduce your taxable income, which in turn reduces your tax liability. Knowing what you can deduct and keeping track of receipts and records can make a significant difference.

Some of the most underused yet valuable deductions include:

In 2025, the standard deduction is set at:

If your itemized deductions exceed the standard amount, itemizing is the way to go. Use IRS Schedule A to list deductions and compare.

Regularly tracking deductible expenses throughout the year, using budgeting apps or spreadsheets,ensures you’re ready to take full advantage when filing time arrives.

4. Use a Health Savings Account (HSA)

An HSA is one of the best tools available to minimize your tax liability while also planning for future healthcare costs.

HSAs offer triple tax benefits:

In 2025, HSA contribution limits are:

To qualify, you must be enrolled in a High-Deductible Health Plan (HDHP). Unlike Flexible Spending Accounts (FSAs), HSAs don’t have a “use-it-or-lose-it” rule. Funds roll over year to year and can be invested for long-term growth.

Using an HSA smartly not only reduces your taxable income today but also prepares you for future out-of-pocket medical costs. It’s a tax-advantaged savings strategy that keeps your money working for you.

5. Adjust Your Withholding

If you consistently receive a large refund or owe money each tax season, it may be time to adjust your W-4 withholding. Your goal should be to break even, neither owing nor overpaying.

A tax refund means you’ve given the government an interest-free loan. Owing taxes can lead to penalties and stress. Fine-tuning your withholding allows you to use your income more efficiently during the year.

Use the IRS Tax Withholding Estimator to calculate your ideal withholdings. It factors in your income, dependents, deductions, and credits.

Updating your W-4 form with your employer takes just minutes and ensures you’re not giving away more than necessary. In 2025, make this a priority to keep your money in your pocket and minimize your tax liability all year long.

6. Defer Income or Accelerate Expenses

If you’re self-employed, own a small business, or earn freelance income, timing your income and expenses is a key strategy to reduce taxes.

Here’s how:

This strategy is especially useful at the end of the year. By deferring income and front loading expenses, you reduce your current-year profit and your tax bill.

Work with a tax professional to ensure compliance with IRS rules, particularly regarding what counts as legitimate expenses. With the right planning, timing alone can substantially minimize your tax liability without reducing your earnings.

7. Work With a Tax Professional

While DIY tax software can work for simple returns, hiring a tax professional is often the best way to ensure you’re optimizing every opportunity to minimize your tax liability.

A certified CPA or enrolled agent can:

Tax professionals stay updated on tax code changes, like inflation adjustments or updates to the TCJA (Tax Cuts and Jobs Act), so you don’t have to.

The cost of hiring a pro is often far less than the amount you save in taxes. It’s an investment in your financial health that can pay dividends for years.

Final Thoughts: Take Control of Your Tax Future (500 Words)

The idea of taxes can feel overwhelming. But with the right strategy, you can confidently minimize your tax liability, legally and efficiently. These are not complex, out-of-reach tactics reserved for millionaires or accountants. Anyone, regardless of income level or filing status, can take powerful action to save money.

Start by assessing your current tax situation. Are you using all available deductions and credits? Are you contributing to retirement or HSA accounts? Have you reviewed your withholding? These tax planning tips may seem basic, but when executed consistently, they can significantly reduce what you owe.

A huge part of any strategy to minimize your tax liability involves knowing how to legally reduce taxable income. This includes contributions to retirement plans, writing off qualified business expenses, and strategically timing income and expenses. These are all methods of legal tax reduction that the IRS allows and even encourages, through favorable tax treatment.

Remember, it’s not about evading taxes. It’s about applying the rules in your favor. Learning how to lower taxes through smart financial decisions ensures that more of your income stays in your pocket, so you can invest, save, or spend as you choose.

2025 will continue to bring tax code updates, inflation adjustments, and new IRS policies. Staying proactive and informed is the only way to stay ahead. If you’re not confident doing it all on your own, work with a tax professional to guide you through the most effective strategies to minimize your tax liability while staying fully compliant.

The earlier you begin, the more you’ll save. Don’t wait for next April, start today. The money you save now will grow exponentially over time. Whether you’re building a nest egg, saving for college, or trying to make ends meet, a tax-smart strategy will always serve you well.

In the end, the real win isn’t just paying less, it’s being empowered to manage your money better. With smart choices, clear goals, and a strong tax plan, you’ll not only minimize your tax liability but maximize your financial peace of mind.

Take control of your money, read our full guide on understanding risk in investments