Introduction

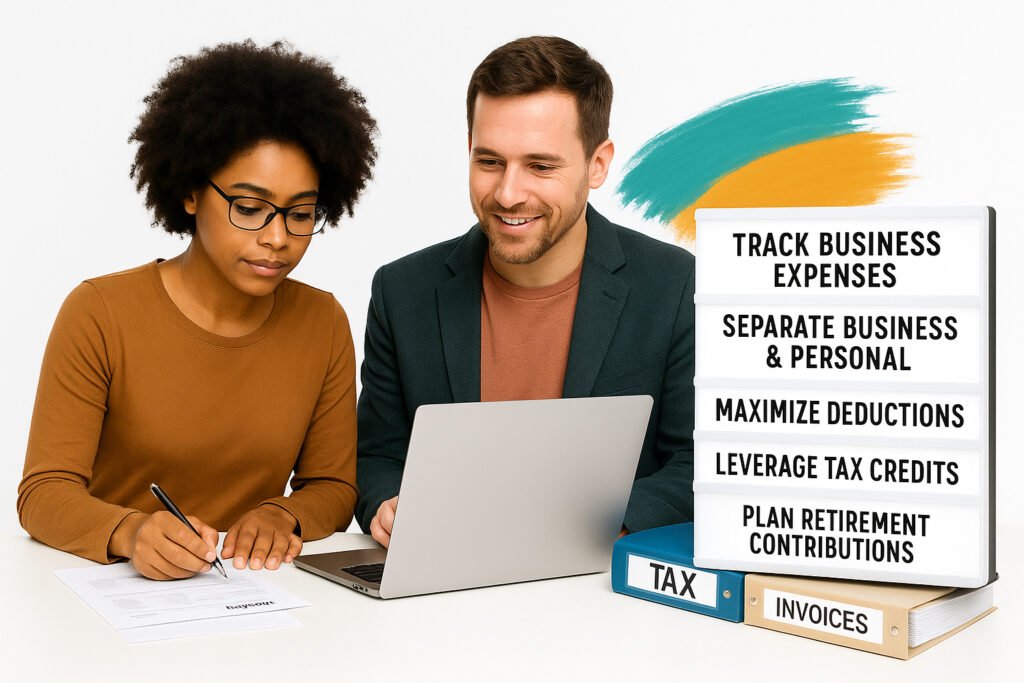

Freelancers and entrepreneurs often enjoy more freedom than traditional employees, but that freedom comes with added responsibility, especially when it comes to taxes. Without an employer handling withholdings, you’re solely responsible for tracking your income, expenses, and tax obligations. That’s why tax planning for freelancers and entrepreneurs is not optional, it’s essential.

As we head into 2025, tax laws are evolving, and the IRS is paying closer attention to self-employed professionals. Whether you’re a digital marketer, content creator, consultant, or run an online store, your ability to stay organized and proactive will determine whether you overpay, underpay, or save thousands. Proper tax planning for freelancers and entrepreneurs allows you to reduce your taxable income, avoid penalties, and leverage deductions and credits that are often overlooked.

Unlike W-2 employees, freelancers and entrepreneurs must pay self-employment taxes, including Social Security and Medicare, typically at 15.3%. On top of that, you’re expected to make quarterly estimated payments. Without a plan, this can lead to surprises, both financial and legal.

In 2025, tax-saving opportunities remain abundant. The IRS offers legal pathways to lower your taxable income, from retirement contributions and business deductions to home office write-offs and healthcare savings. With the right strategy, you can take advantage of these opportunities and minimize your tax burden.

This guide offers 7 smart tips for tax planning for freelancers and entrepreneurs, designed to help you stay compliant, reduce taxes, and position your business for long-term success. Each tip is rooted in current tax law and tailored specifically for the unique challenges that self-employed individuals face.

So if you’re ready to take control of your finances and pay only what you owe, nothing more, let’s dive into these powerful, practical strategies for tax planning for freelancers and entrepreneurs in 2025.

1. Separate Business and Personal Finances

One of the first and most essential steps in effective tax planning for freelancers and entrepreneurs is to keep your business and personal finances completely separate. It may sound simple, but many freelancers and small business owners make the mistake of using one bank account or credit card for everything, which can lead to headaches, confusion, missed deductions, and even IRS trouble.

Separating finances isn’t just about staying organized; it’s a foundational step that makes your tax preparation easier, cleaner, and more defensible in case of an audit. When your business income and expenses are clearly tracked, you’re far more likely to maximize your deductions and accurately report income. All key components of solid tax planning for freelancers and entrepreneurs.

Open a Dedicated Business Bank Account

Start by opening a dedicated business checking account. This account should be used exclusively for receiving payments from clients and paying for business-related expenses. Doing so helps create a paper trail that clearly distinguishes between your business activities and personal life.

Having a separate account allows you to:

It also adds a level of professionalism to your freelance business, which may help you secure more clients who want to work with serious, structured service providers.

Get a Business Credit or Debit Card

Next, get a business credit card or debit card tied to your business account. Use this card for all purchases that are directly related to your freelance work or entrepreneurial ventures. This not only helps build your business credit but also makes it easier to categorize expenses at year’s end.

Whether you’re paying for subscriptions, equipment, advertising, or travel, charging these to a business-specific card simplifies the deduction process and supports cleaner record-keeping, both vital aspects of tax planning for freelancers and entrepreneurs.

Automate and Categorize Expenses

With separate accounts and cards in place, you can use accounting tools like QuickBooks, FreshBooks, or Wave to link your bank feeds and automate expense tracking. These platforms will categorize your business expenses for you, help generate profit-and-loss statements, and offer tax summaries you can hand to your CPA or upload to your tax software.

This automation saves hours of manual work and improves accuracy, which is a core benefit of professional tax planning for freelancers and entrepreneurs.

Protect Yourself in Case of an Audit

One of the biggest risks of mixing personal and business finances is audit exposure. If the IRS decides to review your return, unclear financial records can raise red flags. A separate, well-documented set of financials not only minimizes that risk but makes defending your deductions and income much easier if audited.

In short, keeping your business finances separate isn’t just a recommendation, it’s a requirement for anyone serious about tax planning for freelancers and entrepreneurs. It sets the tone for your entire financial system, streamlines everything else, and keeps you fully prepared when tax season comes around.

2. Track Every Business Expense

One of the most impactful steps in tax planning for freelancers and entrepreneurs is meticulous tracking of every business-related expense. When done correctly, this practice can significantly reduce your taxable income and ensure you’re claiming every legitimate deduction you’re entitled to.

Freelancers and entrepreneurs wear many hats, often juggling client work, marketing, invoicing, and more. But if you don’t take the time to track your expenses, you’re likely missing out on valuable tax savings. Every dollar spent on necessary business activities could lower your tax bill, if properly recorded and categorized.

The IRS allows self-employed individuals to deduct any expense that is “ordinary and necessary” for their trade or profession. For effective tax planning for freelancers and entrepreneurs, this includes, but is not limited to:

The key to claiming these deductions is not just incurring the expense, but documenting it. This means saving receipts, keeping bank statements, and noting what each expense was for.

To make this process easier, use digital tools that are designed for tax planning for freelancers and entrepreneurs. Accounting apps like QuickBooks Self-Employed, Wave, or FreshBooks automatically track income and categorize expenses. Many of them connect to your bank and credit card accounts, reducing manual entry and making tax time much simpler.

If you prefer a manual method, you can use Excel or Google Sheets to create a custom expense tracker. Just be consistent, track all business-related transactions monthly, not just when tax season arrives.

One area that’s often overlooked is mileage. If you use your personal vehicle for business errands, meetings, or events, the IRS allows you to deduct the business-use portion using the standard mileage rate. In 2025, that rate is expected to be around 65 cents per mile (TBD). Apps like MileIQ or Everlance make it easy to track mileage automatically from your smartphone.

Proper documentation is also your best defense in case of an IRS audit. If your deductions are ever questioned, being able to show receipts, mileage logs, and digital records will protect you and validate your claims.

The bottom line? Expense tracking is not just busywork, it’s a strategic move for anyone serious about tax planning for freelancers and entrepreneurs. The more accurate and thorough your records, the more deductions you can claim, and the less tax you’ll legally owe. It’s one of the easiest ways to maximize your financial advantage as an independent professional.

3. Make Quarterly Estimated Tax Payments

For freelancers and entrepreneurs, understanding estimated taxes is one of the most critical parts of effective tax planning for freelancers and entrepreneurs. Unlike traditional employees who have taxes automatically withheld from their paychecks, self-employed individuals are responsible for calculating and paying their own taxes throughout the year.

If you expect to owe at least $1,000 in taxes for the year, the IRS requires that you make quarterly estimated tax payments. These payments include both income tax and self-employment tax (which covers Social Security and Medicare). Failing to make timely payments can lead to underpayment penalties, even if you end up paying the correct amount by year’s end.

Quarterly Deadlines for 2025:

To avoid any surprises, it’s essential to calculate how much you owe as early as possible. The most reliable way to estimate your payments is by using IRS Form 1040-ES or online calculators designed specifically for freelancers. If you have inconsistent income, as many freelancers do, you may need to recalculate your payments each quarter based on year-to-date earnings.

An effective system for tax planning for freelancers and entrepreneurs includes setting aside a portion of every payment you receive. A good rule of thumb is to save 25–30% of your gross income in a separate savings account reserved solely for taxes. This helps prevent the stress of scrambling for funds when payment deadlines approach.

Working with a CPA or using tax software tailored for the self-employed can make quarterly payments less daunting. These tools can project your income and tax liability, making sure you stay on track and avoid IRS penalties. Automation can also help; many online banks allow you to create automatic transfers into your “tax holding” account each time you’re paid.

Making quarterly payments not only protects you from penalties but also helps smooth your cash flow. Instead of facing a massive tax bill in April, you’re spreading the liability over four manageable payments. This is smart financial behavior and a core component of responsible tax planning for freelancers and entrepreneurs.

Keep in mind that some states also require estimated tax payments. Check your state’s tax website or consult with a local tax advisor to ensure you’re meeting both federal and state obligations.

In summary, paying your taxes quarterly is not just a legal requirement, it’s a best practice that will serve your business long term. It demonstrates that you are proactive, disciplined, and serious about your financial obligations. For anyone pursuing tax planning for freelancers and entrepreneurs, mastering estimated tax payments is one of the most important habits to develop early in your career.

4. Maximize Deductions and Write-Offs

Maximizing deductions is where real savings happen in tax planning for freelancers and entrepreneurs. Every qualified deduction lowers your taxable income, which directly reduces how much tax you owe. Understanding what you can legally write off is essential if you want to keep more of your earnings and avoid overpaying the IRS.

Unlike W-2 employees, freelancers and entrepreneurs can deduct a wide variety of business expenses, provided they are considered “ordinary and necessary” according to IRS guidelines. The more expenses you can legitimately deduct, the lower your tax bill and the more profitable your business becomes.

Common Deductions for Freelancers and Entrepreneurs:

Proper documentation is key. Save all receipts and invoices, keep detailed records, and organize your documents by category. Using accounting software can simplify this process and provide reports that help you review deductible expenses at the end of the year.

Many freelancers miss out on significant savings simply because they don’t know what qualifies as a deduction. That’s why tax planning for freelancers and entrepreneurs should be a year-round activity, not something left until April. Review your expenses monthly to ensure you’re not overlooking deductible costs that can make a real difference.

Another important area of tax planning for freelancers and entrepreneurs is the Section 179 deduction, which allows you to deduct the full purchase price of qualifying business equipment in the year it’s placed in service, rather than depreciating it over several years. This can be a major tax break if you’re upgrading your tools or tech in 2025.

Planning purchases around the tax year can also boost your deduction power. For example, buying software or attending a business course in December instead of January can give you a tax break this year instead of next.

In short, knowing your eligible deductions and keeping excellent records is a smart and legal way to reduce your taxable income. For anyone serious about tax planning for freelancers and entrepreneurs, mastering deductions is one of the most powerful ways to pay less in taxes and grow your business more efficiently.

5. Contribute to a Retirement Plan

One of the most powerful and often overlooked strategies in tax planning for freelancers and entrepreneurs is contributing to a retirement plan. While traditional employees often rely on employer-sponsored 401(k) plans, self-employed individuals must take the initiative to set up their own retirement savings vehicles. Doing so not only secures your financial future but also delivers immediate tax benefits.

Unlike typical savings accounts, retirement contributions often reduce your adjusted gross income (AGI), which means a lower tax bill. When structured properly, your retirement plan becomes both a wealth-building tool and a tax-shielding strategy, making it a cornerstone of smart tax planning for freelancers and entrepreneurs.

Here are some top retirement plan options available in 2025:

🟩 Traditional IRA

🟩 SEP IRA (Simplified Employee Pension)

🟩 Solo 401(k)

All of these plans allow you to defer taxes while your money grows. That’s why they’re essential in long-term tax planning for freelancers and entrepreneurs. By lowering your taxable income today, you effectively push taxes into retirement, when your income may be lower and your tax rate reduced.

Not only do these contributions provide immediate tax savings, but they also help ensure long-term financial security, which is particularly important for freelancers and entrepreneurs who don’t have access to traditional pension plans or employer matches.

To take full advantage, consider working with a financial advisor or using a reputable investment platform that offers these self-employed retirement plans. Many online brokers offer quick setup for Solo 401(k)s and SEP IRAs, often with no account maintenance fees.

Also, timing matters. While IRAs typically allow contributions up until the tax filing deadline, Solo 401(k) contributions usually must be made by December 31 for calendar-year taxpayers. Planning these contributions in advance is critical for anyone focused on tax planning for freelancers and entrepreneurs.

Finally, remember that contributing to retirement is more than a tax strategy, it’s a business mindset. It reflects a commitment to sustainability, long-term thinking, and responsible financial management.

Incorporating retirement contributions into your annual tax strategy is one of the smartest moves you can make. It lowers your current tax bill while simultaneously helping you build wealth. If you’re serious about tax planning for freelancers and entrepreneurs, this is one tip you simply cannot afford to skip.

6. Use a Health Savings Account (HSA) If Eligible

One of the most underutilized but incredibly powerful tools in tax planning for freelancers and entrepreneurs is the Health Savings Account (HSA). If you’re self-employed and enrolled in a high-deductible health plan (HDHP), you may qualify for an HSA, and the tax advantages are hard to beat.

An HSA is a triple tax-advantaged savings account, meaning it offers tax benefits at three critical stages:

Contributions are tax-deductible—they reduce your taxable income.

These triple benefits make HSAs one of the smartest strategies for tax planning for freelancers and entrepreneurs, especially for those who don’t have employer-sponsored health coverage.

HSA Contribution Limits for 2025:

These contributions can be made until the tax filing deadline in April 2026 for the 2025 tax year, giving you extra time to plan and maximize your deduction.

HSAs are not “use it or lose it” accounts. Unused funds roll over each year and can be saved indefinitely. You can even invest the balance once it exceeds a certain threshold (typically $1,000 or $2,000 depending on the provider), turning your HSA into a long-term growth vehicle for healthcare-related costs later in life.

This level of flexibility and tax efficiency is why HSAs are so valuable in tax planning for freelancers and entrepreneurs. They serve a dual role: reducing taxes today and preparing for future medical expenses without the burden of taxes.

Freelancers often face unpredictable healthcare expenses, and HSAs provide a safety net while lowering your tax burden. Whether you’re paying for prescriptions, doctor visits, dental work, mental health services, or even vision care, qualified expenses are tax-free when paid through your HSA.

To open an HSA, you’ll need to be covered under a qualifying HDHP. Many online banks and financial institutions offer HSAs with investment options, low fees, and user-friendly interfaces that make them accessible and easy to manage.

Another major benefit? If you don’t use your HSA funds for medical expenses, they can still be withdrawn after age 65, penalty-free (though subject to ordinary income tax, just like traditional IRAs). This turns your HSA into a powerful supplemental retirement tool, aligning perfectly with the long-term goals of tax planning for freelancers and entrepreneurs.

In short, HSAs provide flexibility, long-term growth, and serious tax savings. If you qualify, maximizing your HSA contributions each year should be a priority. It’s one of the most overlooked ways to legally reduce your taxes while preparing for the inevitable healthcare costs of the future.

If you’re serious about tax planning for freelancers and entrepreneurs, and you’re eligible for an HSA, don’t let this opportunity slip by.

7. Work With a Tax Professional

Even the most financially savvy freelancers can find tax season stressful. The ever-changing rules, evolving IRS policies, and complex deductions can become overwhelming, especially as your income grows or your business becomes more complex. That’s why one of the most effective tips for tax planning for freelancers and entrepreneurs is to work with a qualified tax professional.

While tax software can be helpful for basic returns, it lacks the depth and personalization that a Certified Public Accountant (CPA) or Enrolled Agent (EA) can provide. These professionals specialize in navigating the tax code, identifying strategic opportunities, and ensuring you stay fully compliant with federal and state regulations.

Hiring a tax professional may seem like an extra expense, but in reality, it often pays for itself, many times over. A knowledgeable expert can help you:

For optimal tax planning for freelancers and entrepreneurs, working with a professional also means you can engage in tax forecasting. This proactive approach looks at your year-round income trends, changes in expenses, and business growth to help you project your tax liability before deadlines arrive.

Tax professionals can also help you select the most advantageous business entity. For example, transitioning from a sole proprietorship to an S-Corporation may save you thousands in self-employment tax, if your income reaches a certain threshold. This decision alone could transform your tax strategy and increase your take-home pay.

Additionally, a tax expert can help you stay ahead of legislative changes. In 2025, tax laws are likely to shift in response to inflation, budget adjustments, and economic factors. Having someone who monitors these changes ensures your tax planning for freelancers and entrepreneurs remains up-to-date and optimized.

For freelancers with multiple income streams, such as digital products, online courses, affiliate income, or service retainers, a CPA can also guide you on how to best report income and manage bookkeeping. As your business grows, complexity follows. A professional will help you stay organized and compliant without sacrificing growth.

Many tax professionals offer package plans or ongoing consultations, allowing you to check in quarterly and adjust strategy in real time. This not only simplifies your life but also turns tax planning into a year-round strength, not a last-minute scramble.

When it comes to tax planning for freelancers and entrepreneurs, going it alone might save money upfront, but it often costs more in the long run through missed opportunities and avoidable errors.

If you’re serious about saving money, staying compliant, and building a financially secure business, make a tax professional part of your team. It’s one of the smartest investments you can make as a freelancer or entrepreneur.

👉 Want to build a rock-solid foundation for your money management?

Read our full guide: Tax Strategies and Planning